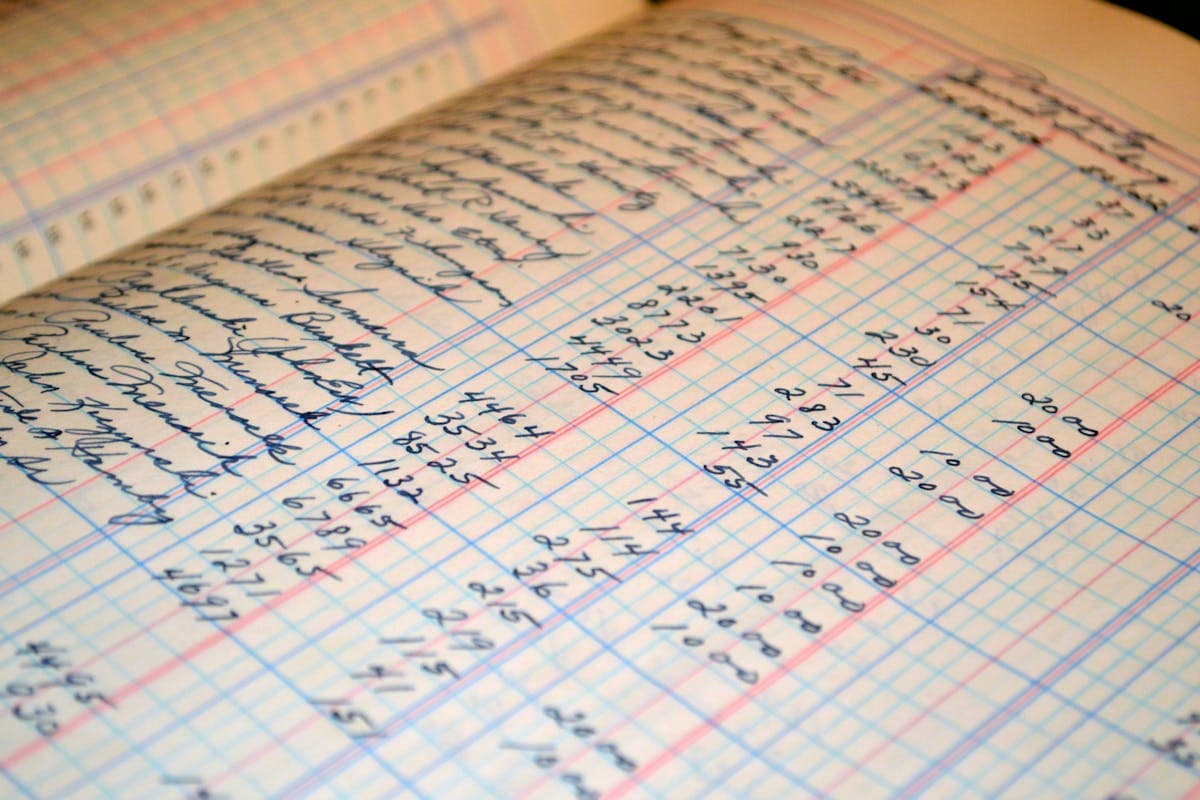

Bookkeeping Services

Get in touchComprehensive financial statement audit, review and compilation for your organization.

Ready when you are

Talk with an auditor

Share a few details and our team will reach out with next steps tailored to your engagement.

Call us directly

855-622-9009Every successful business recognizes that effective bookkeeping is the lifeblood that keeps the business moving. Affordable and effective bookkeeping helps you stay compliant with tax obligations and helps you keep track of important financial milestones for your business. Our bookkeeping service is tailored for small business owners, growing companies, or even individuals with multiple streams of income, ensuring your financial obligations are always met.

Why Bookkeeping Matters

Bookkeeping is about transforming your day to day bookkeeping data into actionable business intelligence. Without accurate bookkeeping records, you put your business at risk for compliance issues, lost financial opportunities, or making uninformed decisions. With Dimov's bookkeepers, you can always expect:

- Accurate recording of all business transactions in real-time – Each of your business expenses, payments, and deposits are categorized and classified accordingly.

- Regular updates of all financial statements – Timely profit and loss statements, balance sheets, and cash flow statements are prepared in real-time for your financial attention.

- Compliance with industry regulations – All records are kept as per the requirements set out by the IRS and state tax bodies.

- Improved strategic and operational business decisions – Prepared detailed reports for better planning and to control costs while optimizing the revenue to be forecast.

What Makes Us Stand Out

We use advanced bookkeeping software for small businesses, QuickBooks, Xero and other cloud-based platforms. We can also recommend the most effective bookkeeping software for small businesses tailored to your industry, operations, and financial plan. From automation tools to real-time dashboards, we help you stay organized with the right tools.

Who We Serve

Dimov assists startup companies, small businesses, and even larger established companies from different sectors. Also, we help contractors, non-profit organizations, real estate agents, e-commerce businesses, and other service providers. Our bookkeeping services adapt to your size and industry.

Why Choose Dimov for Bookkeeping?

- Our team includes experienced CPAs and bookkeepers with knowledge of both US and international accounting.

- Your financial information is stored in secure, cloud-based systems, allowing for anytime access.

- Whether you require part-time help or full-scale services, we provide bespoke service.

- Your records are always maintained in real time so you are ready to prepare and file taxes anytime.

Get Started Today

Your business's bookkeeping should facilitate, not hinder, growth. For those in need of a dependable bookkeeper, e-commerce bookkeeping services, or an accounting department to outsource, we are ready to help. Contact us for a free consultation and discover how professional bookkeeping services help you optimize your finances and ensure compliance.

Contact

Connect with Dimov Audit

Our dedicated team is ready to assist you on your path to financial success.

211 E 43rd St Suite 7-100

New York, NY 10017

United States

401 NW 31ST AVE

Miami, FL 33125-4228

United States

Dimov CPA gave us the clean audit we needed to meet compliance and reassure our stakeholders. Their team was thorough, professional, and let us stay focused on our mission.

– Executive Team

Rise and Shine Child Care Centers

Are your financials audit-ready?

Are Your Financials Audit-Ready?

At Dimov Audit, we pride ourselves in quick communication, accurate work, and seamless delivery.

Frequently Asked Questions